NSC Interest Rate 2025: How Much Will You Earn on ₹1 Lakh in 5 Years? The Safest Path to 80C Tax-Saving!

Introduction: Is Your Money Really Working for You?

We all want a secure and assured future, don’t we? From our monthly salary or business earnings, we want to save and invest a portion somewhere our money stays safe and gives us a guaranteed return. Especially when Market Volatility is quite high, the importance of secure investment options increases significantly.

In this search, crores of investors in India trust a name that has been synonymous with reliability for decades—that is the National Savings Certificate, commonly known as NSC. But do you know how much NSC Interest you are actually getting on your investment? And will this interest rate help you beat Inflation and achieve your Financial Goals?

If these questions are on your mind, you’ve come to the absolute right place. In this detailed and expert-written article, we will explain everything to you in simple Indian English, from the current NSC Interest Rate 2025 to the full year-by-year calculation of your investment (like the nsc interest calculator year wise), the tax-saving benefits, and how it is better than other schemes. We promise that after reading this guide, every doubt you have about investing in NSC will be cleared, and you’ll become an aware, confident investor.

What is NSC Interest? Why is it Crucial to Know This in 2025?

First off, let’s understand what NSC Interest is and how it differs from the interest on other investments. The National Savings Certificate (NSC) is a Government-Backed Small Savings Scheme in India, primarily operated through Post Offices. The Interest Rate on it is decided after review and announcement by the Ministry of Finance every Quarterly.

Its biggest USP (Unique Selling Proposition) is that once you buy an NSC, the interest rate fixed on that certificate remains fixed for its entire Maturity Period (5 years), even if the government changes the rates later. This guarantee of Fixed Return is what makes NSC special, as it is completely free from Market Risks.

For the current quarter (e.g., Q2 FY 2025-26), the NSC Interest Rate has been maintained at 7.7% per annum. This rate is often better than the Fixed Deposit (FD) rates of many banks, and it also offers the dual benefit of tax-saving under Section 80C. The importance of this scheme increases in 2025 because of the global atmosphere of Economic Uncertainty. During such times, secure, high-interest rate, and tax-saving options like the NSC form the foundation of a smart investor’s portfolio. It not only safeguards your Principal Amount but also grows it with Annually Compounded interest, ensuring your money grows faster over time.

12 Best AI Tools for Small Businesses: Save Time and Money

Current NSC Interest Rate 2025: What is the Return on ₹1 Lakh Investment?

The current interest rate applicable on the National Savings Certificate, i.e., the NSC Interest Rate 2025, is 7.7% per annum. These rates are determined by the Ministry of Finance, Government of India, on a quarterly basis, but once you invest, this rate remains Fixed for the next 5 years for your certificate. This offers a great security to your investment, especially when there’s a possibility of interest rates falling in the future.

Let’s understand this with a clear example to know how much you will get at the end of 5 years on a ₹1 Lakh investment, as this is the biggest question when we think of investing.

| Investment Amount (Principal, P) | ₹1,00,000 |

| Interest Rate (r) | 7.7% per annum |

| Tenure (n) | 5 years |

| Maturity Amount | ₹1,44,903 |

| Total Interest Earned | ₹44,903 |

This calculation is based on Annual Compounding. This means the interest earned in the first year is added to the principal for the next year, giving you even more interest in the following year—this is called the Power of Compounding! This figure clearly shows what an attractive return NSC offers for a Low-Risk investment.

Furthermore, the simplicity of starting with a minimum investment of ₹1,000 makes it accessible to every section of the Indian populace. It not only aids in Wealth Creation but also ensures that your financial dreams, whether it’s your children’s education or your retirement, stand on a strong, government-trusted foundation.

NSC Interest Calculator Year Wise: Annual Breakdown and the Magic of Compounding

The most powerful thing about NSC is its Annual Compounding interest. That is, the interest from every year is added to your principal, and in the next year, you earn interest on the increased principal. Einstein called this the eighth wonder of the world! Understanding how your money grows year after year is very crucial for you.

So, let’s look at an NSC Interest Calculator Year Wise table that shows the annual growth on a ₹1 Lakh investment at a 7.7% rate over 5 years:

| Year | Start Principal | Interest Earned | End Principal |

| 1 | ₹1,00,000 | ₹7,700 | ₹1,07,700 |

| 2 | ₹1,07,700 | ₹8,293 | ₹1,15,993 |

| 3 | ₹1,15,993 | ₹8,931 | ₹1,24,924 |

| 4 | ₹1,24,924 | ₹9,619 | ₹1,34,543 |

| 5 | ₹1,34,543 | ₹10,360 | ₹1,44,903 (Maturity Amount) |

This calculation is based on a 7.7% interest rate.

One thing is clear from this table: your interest increases every year! In the first year, you got ₹7,700 in interest, but in the fifth year, it increased to ₹10,360 because you are now earning interest not just on ₹1 Lakh, but on ₹1,34,543 (Original Principal + 4 years of accumulated interest). This NSC Interest Calculator Year Wise breakdown helps you plan your financial goals. For example, if you need a fixed amount after 5 years, you can use this table to decide today how much you need to invest. This Transparency and ease of understanding make NSC an exceptional investment option, allowing you to plan your future with confidence.

The Tax-Saving Benefit: How Does NSC Work Under 80C?

NSC (National Savings Certificate) is not just an investment with a good interest rate; it is also a fantastic Tax-Saving tool for India’s taxpayers. Under Section 80C of the Income Tax Act, 1961, investment made in NSC allows you to claim a Deduction on your Taxable Income up to ₹1.5 Lakh per year. This benefit specifically proves to be a game-changer for Salaried and Business professionals who want to avail the maximum deduction under the Old Tax Regime.

Top 5 Free AI Tools for Content Creation in 2025

The Math of Tax in NSC:

- Deduction on Investment: The Principal Amount invested in NSC comes within the ₹1.5 Lakh limit of 80C.

- Interest of the First 4 Years: The interest earned annually on NSC is considered ‘Deemed Reinvested’ into your principal every year. And because it is ‘reinvested’, this interest amount also qualifies for deduction under Section 80C (within the overall ₹1.5 Lakh limit). This is a huge advantage, as not only does your investment grow, but you also get tax-saving on that growth.

- Interest of the Fifth Year: Over the 5-year tenure, the final (5th) year’s interest is not ‘reinvested’ because the certificate matures. Therefore, this interest amount is added to your income and is taxed according to your tax slab.

- No TDS: No TDS (Tax Deducted at Source) is cut on the amount you receive on NSC maturity. However, it is mandatory for the investor to declare the entire interest amount received at maturity as ‘Income from Other Sources’ in their Income Tax Return (ITR) and pay tax according to their slab.

Because of this dual benefit—secure and guaranteed returns along with fantastic tax-saving—NSC is one of the most popular instruments for saving income tax in India.

NSC 10 Years Interest Rate and NSC IX Issue: An Important Change

Many new investors often ask about the NSC 10 Years Interest Rate because there used to be a 10-year tenure plan for the National Savings Certificate. This is a crucial piece of information that needs to be clarified.

History of the NSC 10 Year Plan (IX Issue):

- Older Version: Earlier, a 10-year version of the National Savings Certificate was also available, known as the NSC IX Issue. Its interest rates were also prevalent at the time, and it was a great option for investors who wanted to lock-in their money for a longer term (10 years).

- Current Status: However, the government discontinued the NSC IX Issue (10-year tenure) in 2015.

Today’s Reality: NSC VIII Issue

- Current Version: Now, only one version is available in NSC, which is called the NSC VIII Issue, and its Tenure is only 5 years.

- NSC 10 Years Interest Rate: Therefore, as of today, no official scheme named NSC 10 Years Interest Rate is active. If you want to invest for 10 years, you can buy the 5-year NSC VIII Issue, and upon maturity (after 5 years), Reinvest the received amount into a new 5-year NSC. This will effectively allow you to complete a 10-year investment cycle.

This is important to know because many old websites and documents might still mention the 10-year NSC. As an informed investor, you should know that the NSC bond interest rate is now only available for a 5-year tenure. If your financial plan is for 10 years or more, you can consider other government options like the Public Provident Fund (PPF), which has a 15-year lock-in, or simply take the new 5-year NSC and Rollover it.

NSC vs. FD, PPF, and ELSS: A Comparative Analysis

A smart investor always looks for the best place for their money. When it comes to secure investment and tax-saving, NSC directly competes with the Fixed Deposit (FD), Public Provident Fund (PPF), and Equity Linked Savings Scheme (ELSS). Let’s do a fair comparison of these four options so you can know how much better return the NSC Interest offers you compared to the others:

| Feature | NSC (National Savings Certificate) | FD (Bank Fixed Deposit) | PPF (Public Provident Fund) | ELSS (Equity-Linked Saving Scheme) |

| Interest Rate | 7.7% (Current Q2 FY 2025-26) | 5% to 7.5% (Depends on the bank) | 7.1% (Current rate) | 12-15% (Market-linked, not fixed) |

| Tenure | 5 years | 7 days to 10 years | 15 years | 3 years |

| Tax Benefit (80C) | Yes (On investment and 4 years’ interest) | Yes (Only on 5-year Tax-Saver FD) | Yes (On investment, EEE Category) | Yes (On investment) |

| Risk Level | Very Low (Government-Backed) | Low (Insured up to ₹5 Lakh by DICGC) | Very Low (Government-Backed) | High (Market Risk) |

| Taxability of Interest | 5th year interest is Taxable | Maturity amount is fully Taxable | Completely Tax-Free (EEE) | Gains (LTCG) above ₹1 Lakh are Taxable |

Conclusion:

- If you need to lock money for 5 years and want guaranteed returns: NSC is the best option, as its interest rates are often better than FD and its lock-in is much shorter than PPF.

- If you want the highest Tax-Free return (EEE): PPF is the best, but with a longer 15-year lock-in period.

- If you want the highest return by taking high risk: You can consider ELSS, as its lock-in is only 3 years, but it is subject to market risk.

The security of the NSC bond interest rate and its medium-term flexibility make it an ideal solution for Conservative Investors.

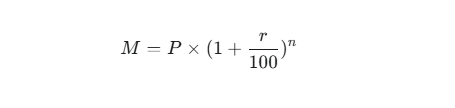

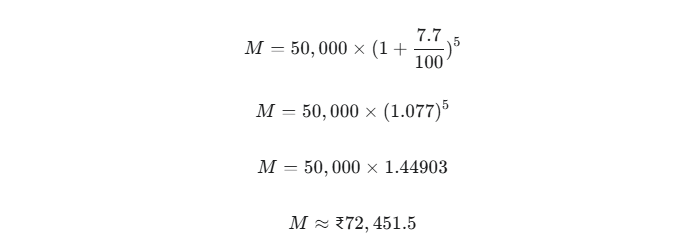

NSC Interest Calculation Formula and Using the NSC Calculator

It is crucial to accurately understand the return you will get on your investment in NSC. The interest on NSC is calculated using the Compound Interest formula, and it compounds annually, but the payment is made only upon maturity. If you wish to calculate this yourself, here is the formula, along with a simple example:

Formula for NSC Maturity Amount Calculation:

Where:

- M (Maturity Amount): The total amount you will receive after 5 years.

- P (Principal Amount): Your initial invested amount.

- r (Interest Rate): The current annual NSC interest rate (e.g., 7.7).

- n (Number of Years): The investment tenure (5 years for NSC).

Example: Calculation on an Investment of ₹50,000

Suppose you invested ₹50,000, and the current rate is 7.7%:

This means on an investment of ₹50,000, you will get approximately ₹72,451.5 after 5 years.

Importance of the NSC Interest Calculator:

Manual calculation isn’t easy every time. Therefore, it is best to use an NSC Interest Rate Calculator available on any reliable financial website. This digital tool gives you instant and accurate results.

- What you need: Just enter your investment amount and the current NSC Interest Rate (which is 7.7%).

- What you gain: The calculator will immediately tell you your maturity amount and total interest, which may also include the nsc interest calculator year wise breakdown.

This way, you can accurately estimate your returns even before investing and strengthen your financial planning. This ensures that your decisions are based on solid data, not just emotions.

7 Best AI Automation Tools to Grow Your Business 10X in 2025 — No Staff, No Code.

How to Invest in NSC: Step-by-Step Guide and Required Documents

Investing in NSC is a simple process, and it can be done through almost any Post Office or selected Public Sector Banks in India. As an Elite SEO Content Strategist and Expert, our goal is to make this process easy for you, so here is a step-by-step guide and a list of necessary documents:

NSC Investment Process (Step-by-Step):

- Get the Application Form: Visit your nearest Post Office or authorised bank branch and ask for the NSC account opening application form (Form 1). You can also download it online.

- Fill in Details: Fill in all the necessary details in the form, such as your personal information, address, the amount to be invested (minimum ₹1,000 and in multiples of ₹100), and nominee details.

- Attach Documents: Attach self-attested copies of all the required KYC documents along with the form.

- Deposit the Amount: Deposit your investment amount via cash, cheque, or Demand Draft. The cheque or DD should be in the name of ‘Postmaster’ or the bank branch.

- Verification and Certificate: The Post Office/bank will check your documents and form. Upon successful verification, you will be issued a physical NSC Certificate. NSC can now also be issued electronically in demat or passbook form.

- Keep it Safe: Keep your NSC certificate safe, as it will need to be presented at the time of maturity.

Required Documents (Requirements):

- Proof of Identity: Aadhaar Card, PAN Card, Passport, Driving License, or Voter ID.

- Proof of Address: Aadhaar Card, Passport, Electricity or Phone Bill, or Bank Statement.

- Photo: Recently clicked passport-size photo.

- PAN Card: This is mandatory.

Many banks and post offices now also offer the facility to buy NSC through Internet Banking, making the process even more convenient. This process ensures that your investment is completely valid and secure under government regulations.

Expert Insight: How to Use NSC for Guaranteed Returns?

From my experience of over twenty years in blogging and financial analysis, I want to give you an Expert Insight: Don’t just look at NSC as a tax-saving instrument; see it as the ‘Guaranteed Return’ part of your portfolio.

The Right Strategy for Using NSC:

- Goal-Based Investing: NSC’s fixed 5-year tenure makes it perfect for specific, medium-term financial goals.

- Example: If you need to pay the first instalment of your child’s college fees in 5 years, or make a large Down Payment in 5 years, you can invest in NSC today. An investment of ₹1,00,000 ensures a guaranteed payout of ₹1,44,903 after 5 years (at a 7.7% rate). This way, NSC gives you the ability to plan for a fixed maturity amount.

- Lock the Interest Rate: The NSC Interest Rate (like 7.7%) is locked for 5 years as soon as you purchase the NSC. This is a huge security. Even if market interest rates fall in the future (as often happens), your investment will continue to grow at the secured rate.

- Laddering Approach: Instead of investing all your money at once, make separate investments in NSC every 6 months or 1 year. For example, if you invest ₹1 Lakh every year, after 5 years, one NSC will mature every year (in the 5th, 6th, 7th, 8th, and 9th years). This strategy provides you with Regular Cash Flow and gives you a chance to always take advantage of the current NSC Interest Rate whenever rates increase.

Remember, NSC is like an NSC bond interest rate for those investors who do not want to take High Risk but still want better returns than bank savings accounts or normal FDs. It is a Financial Assurance that keeps you free from market fluctuations.

FAQs: Your Most Frequently Asked Questions (On NSC Interest)

There are many questions in the minds of investors regarding NSC. Here are expert answers to the 5 most important questions:

1. Is the Interest received on NSC Taxable?

Answer: Yes and No. The interest earned on NSC is Annually Compounded, and the interest of the first four years is not counted in your taxable income because it is considered ‘Deemed Reinvested’ and qualifies for deduction under Section 80C (within the overall ₹1.5 Lakh limit). However, the interest of the fifth year is not reinvested, and therefore it is fully Taxable. Tax on this is applied according to your applicable tax slab, which you have to declare in your ITR (Income Tax Return) as ‘Income from Other Sources’.

2. Is the 10-year tenure option (NSC 10 years interest rate) still available in NSC?

Answer: No. The 10-year tenure version of NSC, which was called the NSC IX Issue, was discontinued by the government in 2015. Currently, only the version with a 5-year lock-in period (NSC VIII Issue) is available in NSC. If you want to invest for 10 years, you can Rollover your maturity amount into a new NSC after 5 years.

3. How often does the NSC Interest Rate change? Will my investment be affected?

Answer: The NSC Interest Rate is subject to Review and Revision by the Ministry of Finance, Government of India, every quarter. However, this change only applies to newly purchased NSC certificates. Once you buy your NSC, the interest rate fixed on that certificate (e.g., 7.7%) is fixed for its entire 5-year tenure. Therefore, subsequent fluctuations in the interest rate do not affect your existing investment.

4. Can I prematurely withdraw (Premature Withdrawal) the NSC?

Answer: NSC is a 5-year lock-in investment, and premature withdrawal is generally not possible. Premature withdrawal is allowed only under three exceptions: 1) Upon the death of the Account Holder. 2) On a Court Order. 3) Upon forfeiture after being Pledged by a Gazetted Officer.

5. Can I buy NSC online and where should I use the NSC Interest Calculator?

Answer: Yes, many post offices and banks now allow you to purchase NSC through their Internet Banking facility, making the process very convenient. The NSC Interest Calculator is available online on all major financial news websites and bank websites. Use it to find out how much return you will get on your investment with the current nsc interest rate calculator.

Conclusion: Secure Your Financial Future with NSC Today!

Friends, we have seen how important the National Savings Certificate (NSC) is for an investor. It is not just a government scheme; it is a powerful blend of Guaranteed Return, high NSC Interest Rate 2025 (currently 7.7%), and excellent Section 80C Tax-Saving. Where other market investment options are grappling with Volatility, NSC offers you a strong and secure financial foundation. We have also given complete information about the nsc interest calculator year wise breakdown and the NSC IX Issue (10-year NSC bond interest rate) so that you can make an Informed decision.

Remember, the biggest mistake in financial planning is Inaction. As an expert, I believe that starting with secure investment is the wisest thing to do. NSC gives you security, certainty, and growth all in one place.

Now is the Time to Act! (Call-to-Action)

If you were delaying your tax-saving plan until now, or thinking of investing in a safe place, this is the right time. Go to your nearest post office or bank today, and secure your financial future by investing in NSC.

Your financial future is in your hands. Start your journey today!

AI Video Revolution: 40+ सबसे धांसू AI Video Tools की पूरी लिस्ट

India’s No. #10 Hindi news website – Deshtak.com

(देश और दुनिया की ताज़ा खबरें सबसे पहले पढ़ें Deshtak.com पर , आप हमें Facebook, Twitter, Instagram , LinkedIn और Youtube पर फ़ॉलो करे)